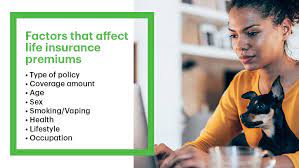

When Which Of These Factors Does Not Influence An Applicant’S Need For Life Insurance? it comes to choosing the right life insurance policy, many people mistakenly think that only health and financial factors influence an applicant’s need for life insurance. Wrong. In fact, there are several other factors that play a role in whether or not someone needs life insurance. In this blog post, we will explore which of these factors does not influence an applicant’s need for life insurance. From family history to mental health conditions, read on to learn more about what you need to know if you’re in the market for a policy.

Age

There are many things that can influence an applicant’s need for life insurance, but age is not one of them. In fact, older applicants may actually be more likely to need life insurance because they’re more likely to face risks that could lead to death, such as a cancer diagnosis.

Some other factors that can influence an applicant’s need for life insurance include whether the applicant has children, how much money the applicant has saved, and whether the applicant is in a high-risk profession.

Marital Status

Life insurance is a necessity for many couples, but which of these factors does not influence an applicant’s need for life insurance?

Some factors that may not influence an applicant’s need for life insurance include: marital status, age, health condition, number of dependents, and income.

Number of Children

According to a study by the Employee Benefit Research Institute, not one of these factors influences an applicant’s need for life insurance. Instead, the study found that family income, age, occupation and housing status were the most significant factors in predicting whether or not an individual would need life insurance.

Income

There are many factors that influence an applicant’s need for life insurance, but some of them are not as important as others. Some of the factors that are not as important include age, sex, occupation and family size.

The most important factor that influences an applicant’s need for life insurance is the individual’s risk profile. This includes things like whether the applicant has any pre-existing conditions or injuries that could increase their risk of dying in a accident. The amount of life insurance that an applicant needs will also depend on their income and savings.

Residence

There are a few factors that do not influence an applicant’s need for life insurance, including marital status, occupation, age, and health. However, these factors can still be considered when allocating life insurance premiums.

Employment Status

When considering whether or not an applicant needs life insurance, many factors should be considered, including employment status and income. Although many employers provide life insurance as a benefit to their employees, some applicants do not need life insurance if they have a secure job with good pay and retirement benefits. Other applicants may need life insurance if they are self-employed or earn less than a certain amount of money.

Some other factors that should be considered when determining an applicant’s need for life insurance include whether the applicant has young children or plans to have any in the future, whether the applicant is married or has a partner, and whether the applicant has any health conditions that could lead to death.

Health History

There are many factors which can influence an applicant’s need for life insurance, but not all of them are relevant to each individual. Some factors which may be irrelevant to an individual person include age, sex, occupation and lifestyle.

Age is one of the most important factors which cannot be ignored when it comes to life insurance. Younger people generally have less experience and memories to protect them should something happen, meaning they may be more likely to require help from family or friends if they die suddenly. On the other hand, older people may have built up a wealth of possessions and memories which could provide them with some comfort in their absence.

Sex is also a factor which cannot be ignored when it comes to life insurance. Women are typically more likely to live longer than men, so it makes sense that they would need more life insurance than men in order to cover their costs if they died prematurely. This is especially true if they have children who might need financial support following their mother’s death. Men, on the other hand, tend to outlive women by around five years on average, so they generally don’t require as much life insurance coverage as women do.

Occupation is another factor which cannot be ignored when it comes to life insurance. People who are employed will generally want more life insurance coverage than people who are not employed because they know that they may lose their job at any time and wouldn’t be able to afford the cost of a premature death without this protection. Additionally,

Insurer Preferences

Many people believe that the following factors do not influence an applicant’s need for life insurance: age, sex, occupation, marital status, number of dependents. However, this is not always the case.

An applicant’s health and genetic history can play a role in whether or not they need life insurance. If an individual has a family history of heart disease or cancer, they may be at a higher risk for developing either condition and may consequently need life insurance to protect their loved ones should they become incapacitated. Additionally, certain occupations – such as firefighters – are more likely to be put in dangerous situations that could lead to death or injury on the job. In these cases, life insurance can provide financial security for the family members left behind should the firefighter pass away prematurely.

Another factor that can influence an individual’s need for life insurance is their marital status. Married couples typically have more economic stability than unmarried individuals and are therefore less likely to face unforeseen financial challenges down the road. This means that a married couple may be better off purchasing life insurance together rather than each paying separately. If one spouse predeceases the other, their spouse will still be able to benefit from the policy regardless of whether they were married at the time of death.

A final factor that can influence an individual’s need for life insurance is their number of dependents. If someone only has themselves as a dependent and does not have any other family members who could rely on them financially if necessary

Time News Global Business, Technology, Entrepreneurship News

Time News Global Business, Technology, Entrepreneurship News